Kula housing project gains a little ground

WAILUKU – Maui Planning Commission members were unable to agree where to designate growth boundaries in South Maui, but they did make some progress in Kula.

The Kula Ridge housing project had both supporters and doubters before the planning commission.

Part of the project is supposed to be affordable, but some wondered how to ensure that it really turns out that way.

"Don’t get into a project-review decision-making mode," advised Department of Planning Director Jeff Hunt, adding that downstream reviews of matters such as community plan designations can look at projects in detail.

"This is the beginning of a 125-hurdle process," said Chairman Wayne Hedani.

When it came to a vote, the controversial portion of Kula Ridge cleared its hurdle, with commission member Warren Shibuya dissenting over concerns about water and the adequacy of Lower Kula Road.

However, A&B Properties’ bid to add 80 acres to 63 acres for residential development at Haliimaile failed.

Commission member Kent Hiranaga pointed out that the developer is going to provide water and sewage treatment anyway, so it would be financially helpful to expand the project.

"A&B is an agriculture company and a development company," he said. "If we want to allow them to continue the agricultural sector of their business, you need to allow some development. If you take away development, I believe you are jeopardizing the future of sugar cane.

"Then you will have lots of ag land to use for something."

However, farmers – organic and conventional – opposed taking prime agricultural land out of production, and on a split vote the 80 acres were excluded from the designated growth zone.

That Hiranaga moved to support an A&B proposal was ironic in light of earlier testimony.

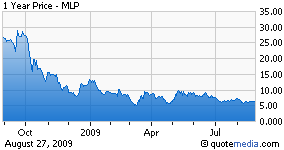

MLP, which owns 24,500 acres primarily in Maui, Hawaii, including 10.6 miles of ocean frontage with 3300 of lineal feet along sandy beaches, has fallen on hard times during the recession. The company recently reported a $54 million loss for the second quarter, which included more than $37 million in writedowns, $21.3 million of which represented a decrease in value of the Company’s investment in the Kapalua Bay resort. Clearly, the downturns in real estate prices and resort visitors has been a double whammy for MLP. The stock now trades at $6.22, down 79% from its 52 week high of $29.69.

MLP, which owns 24,500 acres primarily in Maui, Hawaii, including 10.6 miles of ocean frontage with 3300 of lineal feet along sandy beaches, has fallen on hard times during the recession. The company recently reported a $54 million loss for the second quarter, which included more than $37 million in writedowns, $21.3 million of which represented a decrease in value of the Company’s investment in the Kapalua Bay resort. Clearly, the downturns in real estate prices and resort visitors has been a double whammy for MLP. The stock now trades at $6.22, down 79% from its 52 week high of $29.69.